Article of the Month -

February 2014

|

Retail Market Studies for the Capital Market:

Form versus Substance

Kien Hwa TING, Malaysia

1) This paper is a Malaysian

Peer Review paper, which will be presented at FIG Congress 2014 16-21

June, in Kuala Lumpur, Malaysia. We are pleased to share this Peer

Review paper with you already now prior the congress to highlight one of

the topics - real estate - covered at the congress. On the 19 and 20

June the Board of Valuers, Appraisers and Estate Agents Malaysia has

been invited to participate in the Congress. and together with FIG

Commission 9 and 10 special sessions on valuation and estate

management are being prepared i.e. the launch of the

International Property Measurement Standards (IPMS). Mr.

See Lian ONG, Chair Elect of FIG Commission 10, is furthermore

facilitating a high-level session on Building Information Management,

BIM.

Key words: real estate investment trusts, initial public

offering, retail market study

SUMMARY

The supply and demand condition of the property

market and the attractiveness of the property portfolios are among the

key factors that investors evaluate before deciding to invest in the

initial public offerings of real estate investment trusts (REITs). To

meet this information need for decision-making, a real estate market

study report is often provided within the prospectus for the purpose of

initial public offering (IPO) and listing on the stock exchange.

This paper examines whether these reports meet the

property market information requirements of REIT investors by examining

retail market study reports found in the REIT IPO prospectuses of Bursa

Malaysia for the 2005 to 2013 period.

The analysis of the retail market study reports are

based on criteria derived from literature review on the criticisms of

real estate market studies. Content analysis using the criteria is

applied to examine whether there are weaknesses in the retail market

studies. The analysis found that the general headings and contents of

these retail market studies are generally the same. However a detailed

content analysis reveals that there are weaknesses in the areas of data

analysis and analytical techniques of these retail market studies.

Hence the generally broad headings (i.e. form) found

in the content of a market study may not necessarily provide enough

information/data (i.e. substance) to assist investors in making their

investment decisions.

1. INTRODUCTION

Each REIT initial public offering (IPO) requires a

prospectus to be filed with the Securities Commission and the Stock

Exchange. The prospectus provides details about the REIT investment

offering for sale to the public. A prospectus will contain the facts

that an investor needs to make an informed investment decision. Apart

from the information on the offeror, the properties, the managers, the

trustees, the trust deed etc other important information such as

valuation certificates, proforma balance sheet, profit forecast and

taxation are provided in the appendix of the prospectus.

The supply and demand condition of the property

market and the attractiveness of the property portfolios are among the

key factors that investors evaluate before deciding to invest in the

initial public offerings of real estate investment trusts (REITs). A

real estate market study report is often provided within the prospectus

for the purpose of initial public offering (IPO) and listing on the

stock exchange to meet this information need.

This real estate market study report is a new form of

market study that fulfills the needs of investors and is different from

the traditional market studies that are conducted on new property

development. This paper will examine whether these reports/studies meet

the investment requirements of the REIT investors.

2. REAL ESTATE MARKET STUDY IN THE CAPITAL MARKET

CONTEXT

Market studies are conducted to cover the following

property development and investment situations (Maliza 1992):

-

A use in search of a site (use given, site

unknown)

The market study attempts to identify and select the best site for

the identified use for maximum profit and growth.

-

A site in search of a use (use unknown, site

given)

The study attempts to determine the most fitting and probable use by

studying and comparing legal, physical, market and financial aspects

of alternative uses.

-

Market and financial feasibility are carried for

an identified scheme (use given, site

given)

The study determines the market and financial feasibility of the

proposed project.

-

Capital in search of investment (use known, site

unknown).

A real estate market study analyses the general

market demand for a single or multiple types of properties at a

particular location. Generally real estate market studies are conducted

as part of the development appraisal process (Miles et. al, 2007).

However real estate market studies for the REIT IPOs of the capital

market are for investment appraisal purposes.

In the context of market study for the capital

market, a market study is concerned with the determinants of investment

profitability and its sustainability e.g. population, households,

employment and income etc. Market study is the identification and study

of the market for a particular development/investment. The market study

specifically relates market conditions to the property under evaluation.

It must show how the interaction of supply and demand affects the

feasibility or attractiveness of the development/investment. The study

is used to determine whether there is market support for an existing

property or properties in a portfolio in the foreseeable future (Geltner

et, al, 2013).

An existing retail centre is deemed enjoying maximum

productivity only after an appropriate level of market support has been

demonstrated to exist for that use. In-depth market studies go much

further in specifying the character of that support. Such studies may

determine key positioning strategies, provide estimates on the market

share and absorption rate etc. (Fanning, 2005).

The techniques and procedures of market studies are

getting sophisticated. Market studies can be developed into elaborate

analyses. Fanning (2005) suggests various levels of market analysis that

reflect a spectrum of procedure, methods and techniques.

Myers and Beck (1994) has proposed a ‘four-square

design’ approach to take into account of the present-future and

macro-micro dimensions to conduct a comprehensive market study. A good

market study should take into account of present and future market

conditions and also the macro and micro aspects of the property market.

The objectives of providing a real estate market

study in the prospectus are to meet the following objectives:

-

To provide an overview of the economy and retail

property market,

-

To review the current retail market supply and

demand

-

To highlight key drivers and challenges of retail

market

-

To provide commentary of the retail portfolio of

REITs

-

To conclude on market trend and prospect.

2.1 Guidelines for market study

Real estate professional bodies often provide

guidance to its professional members in carrying out various

professional tasks which covers valuation, ethics and market studies.

In US, a position paper on market analysis in the

appraisal process was adopted by the Joint Valuation/Research

Subcommittees of the National Council of Real Estate Investment

Fiduciaries (NCREIF) in 1995. This was released in an article by Wincott

and Mueller (1995) in The Appraisal Journal. An update of the position

paper was released by NCREIF Valuation Committee on 21 May 2012 (NCREIF,

2012).

In Malaysia, upon the aftermath of the Asian

Financial Crisis, the Bank Negara has recommended to provide property

market studies to support lending to the property sector. A guideline

known as “Market and Feasibility Study Guidelines for Property Projects

or Property Investments” is prepared by The Association of Valuers and

Property Consultants in Private Practice Malaysia (PEPS) in 2001.

The guidelines are prepared in response to the

National Economic Recovery Plan report of August 1998 that bank lending

should be based on merits of the case and supported by detailed market

and feasibility studies.

However the PEPS guidelines to market study cover

merely two pages and all within eleven bullet points. The guidelines did

not provide sufficient details on the content, components and scope of a

good market study. Despite the lack of details in the guidelines,

property consultants had nevertheless continued to prepare market study

reports over the years.

The market study reports found in REIT IPO

prospectuses of Bursa Malaysia provide a research opportunity to examine

the adequacies of these market studies, which are publicly available, in

providing the necessary information for potential REIT investors in

their investment decision making.

3. RESEARCH METHODOLOGY AND DATA

A literature review is carried out to find out the

weaknesses of real estate market studies. Ting (2007) has summarized the

criticisms of market studies under four major stages in carrying out a

market study i.e. data collection, data analysis, analytical techniques

and evaluation. These four major stages are adopted to facilitate a

systematic analysis of the content of a real estate market study report.

The technique of content analysis is applied to

examine the contents of market study report found in the REIT IPO

prospectuses for the 2005 to 2013 period. As the retail market is a more

complex property sector that requires detailed analysis, only the market

study reports that covered the retail market are analysed for this

research. To aid content analysis, words, sentences, paragraphs, tables

and figures relating to retail market prospects are used to examine the

adequacy of the retail market studies whether they satisfy the

objectives of these reports.

To examine the ‘form’ aspect of the retail market

studies, major topics/headings of these reports are collected and to be

evaluated against the market study reports.

To examine the ‘substance’ of these studies, the

strengths and weaknesses of these studies are evaluated against the list

of criticisms by Ting (2007).

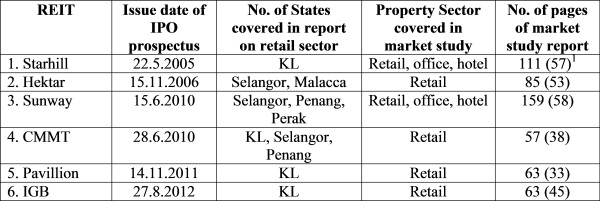

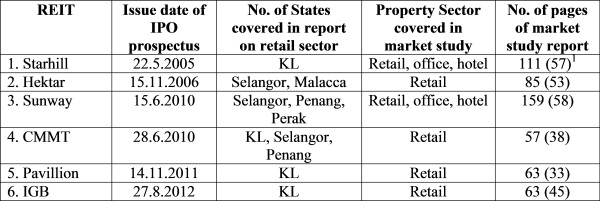

Out of the 15 prospectuses issued during the study

period, only six contain retail market study reports (refer Table 1).

Table 1: Selected REIT prospectuses for content

analysis

Note: 1 – The figures in bracket represent the number of pages dedicated

on retail property market and retail centre analyses.

4. ANALYSIS

4.1 Adequacy of general contents of retail market

reports – the ‘form’ aspect

For analysis, the respective market study reports are

coded and arranged randomly to avoid possible identification of the

property consultancy firms that prepare the reports. Table 2 shows the

results of the analysis.

Table 2: Analysis of general contents of retail

market studies in REIT prospectuses

Note : √ - denotes available; X - denotes not available

From Table 2, we can conclude that the form and the

general contents of the retail market studies are generally the same.

But some aspects of retail market analysis are not covered:

- Trade area analysis

- Performance analysis

- Comparative retail centre assessment

The market studies concerned did not provide any form

of coverage in these areas.

4.2 Adequacies of retail market information for

investment decision making – the ‘substance’ aspect

A retail market study that concludes that there is

good prospect in investing in the REITs should contain analyses and

evaluations that are supported by facts and figures. Table 3 examine and

evaluate whether there are any weaknesses in the retail market studies.

Table 3: Criticisms on retail market studies for REIT

IPOs

Note : √ - denotes weaknesses found in report

Table 3 shows there are distinctive weaknesses in the

retail market studies at two levels i.e. individual studies and common

weaknesses among studies.

At individual report level, two of the reports have

significant weaknesses and the balance four are well prepared.

The common weaknesses among the market studies are

(a) unspecified assumptions (b) lack of future demand projections; and

(c) no capture rate.

Examples of unspecified assumptions are:

-

For the primary and secondary trade areas,

distance and travel time are not specified

-

The primary and secondary trade area are circular

in shape,

-

The existing demand factors are assumed to extend

into the future.

Facts and figures on existing and future supply are

usually provided. Existing supply and demand situations are often

analysed using occupancy rate. However there are no projections provided

for future demand. With the lack of analysis between future supply and

demand, the conclusion made on the future prospects of the shopping

centres in the report is questionable.

The capture rate of each shopping centre is not

specified in the studies. It is assumed to remain constant and is not

affected by new shopping centres coming into operations and within the

trade area. This omission may seriously affect the reliability of the

conclusions of the reports.

5. CONCLUSION

The supply and demand condition of the property

market and the attractiveness of the property portfolios are among the

key factors that investors evaluate before deciding to invest in the

initial public offerings of real estate investment trusts (REITs). To

meet this information need, a real estate market study report is often

provided within the REIT prospectus for the purpose of initial public

offering (IPO) and listing on the stock exchange.

Content analysis using the criteria is applied to

examine whether there are weaknesses in the retail market studies. The

analysis found that the general headings and contents of these retail

market studies are generally the same. However a detailed content

analysis reveals that there are weaknesses in the areas of data analysis

and analytical techniques of these retail market studies.

Hence the generally broad headings (i.e. form) found

in the content of a market study may not necessarily provide enough

information/data (i.e. substance) to assist investors in making their

investment decisions.

In conclusion, the retail market studies found in

REIT IPO prospectuses need to be read in detailed to ensure the

conclusions made are well founded and based on proper analysis of facts

and figures. Before making any investment decisions, a critical reading

of the reports particularly the implicit assumptions made will help

investors to conclude whether there is any sustainable prospect in the

shopping centres owned by the REITs.

REFERENCES

Association of Valuers and Property Consultants in

Private Practice Malaysia. 2001. Market and Feasibility Study Guidelines

for Property Projects or Property Investments PEPS

Babbie, Earl. 2013. Social research counts,

Wadsworth, Cengage Learning

Brett, D. L. and Schmitz, A. 2009. Real estate market

analysis: methods and case studies. 2ed. Urban Land Institute,

Washington, D. C.

Fanning, S. F. 2005. Market analysis for real estate:

concepts and applications in valuation and highest and best use,

Appraisal Institute, Chicago

Fanning, S. F. and Jody Winslow. 1988. Guidelines for

Defining the Scope of Market Analysis in Appraisal Assignments The

Appraisal Journal October

Geltner, D. M., Miller, N., Clayton, J. and

Eichholtz, P. 2013. Commercial real estate, South Western Educational

Publishing

Malizia, E. 1992. A framework for real estate

feasibility research Journal of Property Valuation and Investment,

10(3), 640-645

Miles, Mike E., Berens, G. L., Eppli, M J and Weiss,

M. A. 2007. Real estate development: Principles and process, 4 ed. Urban

Land Institute, Washington, D. C.,

Myers, Dowell and Beck, Kenneth. 1994. A Four-square

Design for Relating the Two Essential Dimensions of Real Estate Market

Studies in DeLislie, J R & Sa-Aadu J ed. Appraisal, Market Analysis &

Public Policy in Real Estate, Real Estate Research Issues Vol.1 Kluwer

Academic Publishers

NCREIF. 2012. Market analysis in the appraisal

process, Valuation Committee Position Paper

Ting, Kien Hwa. 2007. A review of criticisms on real

estate market studies, 23rd American Real Estate Society Conference, San

Francisco, USA

Wincott, D. R. and Mueller, G. R. 1995. Market

analysis in the appraisal Process The Appraisal Journal, January, 27 -

32

CONTACTS

Professor Sr Dr. Kien Hwa TING

Universiti Teknologi MARA

Centre for Real Estate Research (COREResearch)

Faculty of Architecture, Planning & Surveying,

40450 Shah Alam, Selangor

MALAYSIA

Tel. +6035544 4217

Fax + 6035544 4353

Email:

tingkien@salam.uitm.edu.my,

tingkienhwa@yahoo.com

Web site: www.uitm.edu.my

BIOGRAPHICAL NOTE

Professor Sr Dr. Kien Hwa TING, Ph.D.(Finance),

FRICS, FRISM is Head of Centre for Real Estate Research (COREResearch),

Universiti Teknologi MARA, Malaysia.

Prof. Dr. Ting is an Academic Member of Asia Public

Real Estate Association (APREA), a Board member of the Pacific Rim Real

Estate Society, RICS Malaysia Board member, Council member of the Royal

Institution of Surveyors Malaysia and a member of the NAPREC Expert

Panel (INSPEN). In August 2013, Prof. Dr. Ting has been appointed a

member of the Standards Setting Committee to develop a global standard

known as International Property Measurement Standards (IPMS) for

measuring buildings.

Prof. Dr Ting is currently the Editor of The

Malaysian Surveyor and International Surveying Research Journal of Royal

Institution of Surveyors Malaysia. He is also an Editorial Board member

of Pacific Rim Property Research Journal, Journal of Real Estate

Literature and Journal of Corporate Real Estate.

|