ASSESSMENT OF THE MARKET VALUE OF REAL ESTATE WITH PRIVATE HOUSEBUILDING DERIVED FROM THE SUMMATION METHOD OF VALUATION WITH ADJUSTMENT TO CURRENT MARKET VALUEMichael MÜRLE, GermanyKey words: appraisal, property valuation by summation, adjustment to market value. 1. INTRODUCTIONIn order to come to an assessment of the market value in Germany use is to be made to the comparable method of valuation, the capitalised value method of valuation, the summation method of valuation or a number of these methods. In special cases also not standardized methods are put into practice. The market value of real estate with private housebuilding is frequently derived from the result of the summation method. 2. MARKET VALUEThe market value is defined as the price which would be achieved in an ordinary transaction at the time when the assessment is made, taking into account the existing legal circumstances and the actual characteristics, the general condition and location of the property without consideration being given to any extraordinary or personal circumstances. Thereby the definition of the market value in Germany supplies the same result of valuation as the definition of the market value by IVSC, which was accepted by TEGOVA for Europe. 3. SUMMATION METHOD OF VALUATIONAnalysis of purchase prices prove, that especially the assessed value of the summation method of real estate with private housebuilding and the on the property market realised purchase price can be different. By the adjustment factor to current market value, which is derived from the analysis of purchase prices by official committees of valuation experts, follows the adjustment of the summation value to the general state of the property market. In the German Federal Building Code there is a regulation for the official committees of valuation experts to compile data on purchasing prices. For that a copy of every contract by means of which a person enters into an obligation to convey property for payment or in exchange shall be sent by the office where this is recorded to the local official committee of valuation experts. The result is a good transparency of the general conditions of price level of the property market. The proceeding of the summation method of valuation with adjustment to market value is shown in Diagram 1 and Photograph 1.

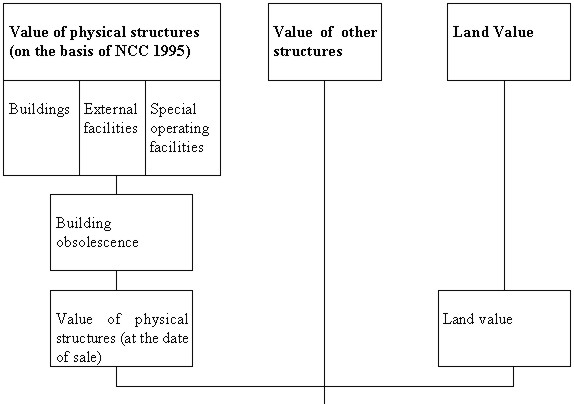

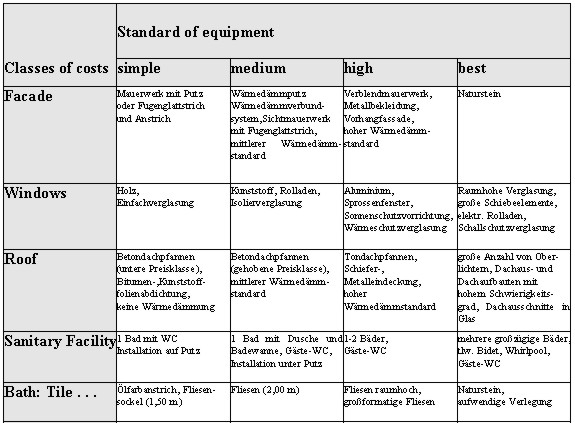

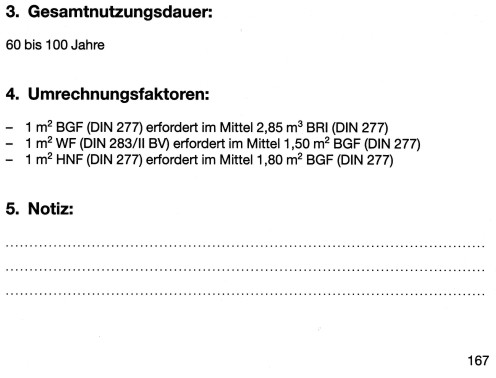

Diagram 1: The summation method of valuation with adjustment to market value The market value results from the summation value in consideration of a supposed condition without defects and damages multiplied by the adjustment factor. The value of physical structures of real estate with private housebuilding is usually estimated on the basis of Normal Construction Costs 1995 (NCC 1995). 4. MODEL OF THE NCC 1995The NCC 1995 are specified by the type of building, standard of equipment (Table 1), class of the year of construction and gross building area respectively gross building volume. The highest criterion is the type of building. Deriving from 33 main types of building with about 70 subtypes of building the catalogue makes a distinction between the coverage type, the number of floors, the form (saddle/flat roof) and the usefulness of a roof and the ground-floor (Table 2). In this connection the customary construction costs for a measure of replacement in consideration of modern, economic types of construction are concerned and not (expensive) reconstruction costs. Data like incidental costs and total service life are also set out.

Table 1: Normal construction costs 1995 - standard of equipment.

Table 2: Normal construction costs 1995 - Detached one family house (Type 1.01) 5. ADJUSTMENT FACTOR ANALYSISExemplary for an analysis of a random test with 115 purchase prices of predominantly detached private housebuildings in the university town Karlsruhe the general analysis proceeding shall be shown. Basis for the analysis of adjustment factors to current market value are immovables, for which the value of the summation method and the purchase price are given. By the assessment of the values of the summation method the NCC 1995 are multiplied by the gross building area. The construction values of garages, individual components of buildings and external facilities - classified in 5 classes with global amounts - are added. The sum is increased by the amount of 15 % for the incidental costs. Subsequently the value of the physical structures at the date of sale is calculated with the building price index and the building obsolescence. The land value is estimated by the standard land value if necessary according to the theory of zoning. Standard land values are average local land values per square metre of real estate area, that are also assessed by the official committees of valuation experts for a plural number of real estate with in the main comparable conditions of use and value level. The summation value is the sum of the land value and the value of the physical structures at the date of sale. For saving time usually the buildings are only observed respectively photographed from the outside (appearance) and questionnaires are sent to assess modernizations, the standards of equipment and building damages. The value of a building damage is not subtracted from the summation value but added to the purchase price. With this method we get adjustment factors to current market value for real estate without defects and damages. Only from the summation value adjusted to current market value the value of a damage is subtracted. On the basis of the compiled data on the purchasing prices a multiple regression analysis is computed. As dependant variable the adjustment factor is defined, as influence variables all collected building marks and the (standard) land value can be considered. The aim is to find a good explaination of the variation of the dependant variable with few influence variables. The quality of the estimated regression function is rated by the square (B) of the multiple correlation coefficient (Mürle/Böser 1997). B takes values in the interval between 0 and 1. All the more B approaches to 1, all the better is the estimated regression function. The best estimation was achieved with the summation value as the sole influence variable and a sharing of the original sample in three classes according to standard land values (Mürle, Sitzler 2001). In a location of high (standard land) value the summation value is corrected with lower reductions or higher additions for adjustment to market value than in a less valuable location (Graph 1). A comparable calculation with the gross building volume does not supply a better result. The unknown (true) adjustment factors lie with 90 percent probability in a confidence interval, that amounts 5 to 10 percent of the assessed (estimated) adjustment factors for standard land values from 225 to 300 €/m² (Graph 2).

Graph1: Adjustment factors to market value dependent on three classes of standard land values and summation value

Graph 2: 90 % - confidence interval for the unknown (true) adjustment factors with standard land values from 225 to 300 €/m² Example The result for a property valuation is elucidated by an example.

6. CONCLUSIONWith this method of the adjustment to current market value the German summation method supplies results, that are adjusted to the real estate market, and can consequently represent European or International praxis of property valuation. The valuation of special immovables without adjustment to the real estate market, that are hardly ever sold on the market, for use of balances, only considers a little section of the valuation praxis and it is impossible to derive general statements to the qualification of the adjusted summation method of valuation.

REFERENCESMürle, M., Böser, W., 1997, Comparable method of valuation for real estate - represented for plots with terrace houses in the city Karlsruhe, Zeitschrift für Vermessungswesen (ZfV), 9000, pages 235-243, Stuttgart, Deutscher Verein für Vermessungswesen e.V. Mürle, M., Sitzler, E., 2001, Analysis about the Normal Construction Costs 1995 on the basis of the assessment of adjustment factors for the summation method of valuation, Zeitschrift für Vermessungswesen (ZfV), 9000, pages 11-15, Stuttgart, Deutscher Verein für Vermessungswesen e.V. BIOGRAPHICAL NOTEAs director of the official committee of valuation experts in the

city Karlsruhe, Michael Mürle is responsible for the

purchasing price data and assessments of the market value, the

creation of appraisal reports and a good transparency of the general

conditions of price level of the property market. He studied geodesy

at University Karlsruhe with the examination as graduate engineer in

1982. CONTACTDipl.-Ing. Michael Mürle 30 April 2001 This page is maintained by the FIG Office. Last revised on 15-03-16. |