THE CHANGES OF KOREAN APPRAISAL MARKETSangho LEE, KoreaKey words: 1. OVERVIEWThree years have passed since the economic crisis plagued the national economy. In retrospect, we have gone through dramatic changes over those three years. After the currency crisis, the real estate market experienced a deep recession. The price of real estate plunged sharply and the number of real estate transactions also decreased markedly. To overcome the impacts of such crisis, a number of programs have, are being and will be adopted by the government to rehabilitate the national economy. Thanks to the blood-and-tears endeavors of the government and Korean, all the economic indicators improved sharply pre-currency crisis level. It has also been reported that the Korean economy has now completely pulled itself out of the currency crisis. Despite this favorable report, the Korea economy has again been showing signs of hardship since the second half of 2000. These recent afflictions are largely related to the fundamentals of the economy and the resulting side effects. The currency crisis triggered off waves of economic restructuring throughout the nation. Especially, the financial and corporate sector restructuring is still under way to make them conduct business in a sound basis based on market principles. Looking at the bright side of the crisis, It is true that this shock has acted on rather affirmative than negative to Korea economy especially in the fundamental of the economy. Thus, this crisis should be turned to our advantage considering that we could draw a moral from this hardship. There is no exception to appraisal market. Actually, the appraisal market was not shrunken back to this currency crisis. On the contrary, the appraisal demand was rising rapidly due to the disposal of real estate for improving corporate capital structure. But, the prospect of appraisal market is so dim that we could not forecast a consequent development of appraisal market. Therefore, appraisal market has also been forced to go with the stream and to reshape its system according to International Standards. It will become obvious that without restructuring fundamentally we will not secure the competitiveness in the global era. 2. STATUS OF KOREA APPRAISAL MARKET2.1 Historic BackgroundIn 1918, the modern appraisal institute was introduced by Choson Industrial Bank (the former self of Bank of Korea), installing technology section, that set to appraise real estate. In the pioneer days, the appraisal department had taken charge of dealing with securities and managing only security-related appraisal for each financial institution. With the liberation of Korea, the colonial properties had been back to the original owners. The liquidation of colonial properties was in need of appraisal. In the following decades, the court auction gave soaring rise to appraisal demand for real estate and showed a standard procedure. Since the early of 1960's, Korea has a remarkable record of high and sustained economic growth. It sparked a number of appraisal demands as collateral for banks. To meet and integrate such an explosive appraisal demand, the government established Korea Appraisal Board (KAB) in 1969. KAB was the first independent public institution assumed full charge of appraisal. Thereafter, the government has produced government certified appraisers. Prior to 1989, Korea had two different appraisers. One was so called 'land appraiser' who took charge of appraisal relating to practical use of national land. The other was so called 'certified appraiser'. Both played a similar role as appraiser. It resulted in an unnecessary investment and squandering of the human resources. The academic world and interested parties had consistently tried to unite two systems. As a result of many years' endeavor, at last, the Act on Land Evaluation and Price Notification (hereafter "Act") was enacted in 1989 and finally both appraisers were unified as 'certified appraiser'. As a result, the current appraisal system is formulated and systematized by integration. 2.2 The Configuration of Appraisal BusinessAt the present time, the January 2001, Korea Appraisal Board (KAB), 27 private corporations (general partnership), 1 joint office, and 208 individual offices were authorized to carry on the business. 166 certified appraisers were affiliated with KAB and about 1,160 certified appraisers belonged to 27 private corporations. Considering the total number of certified appraisers (1,568 members), it shows that KAB & 27 private corporations have approximately more than 84% out of the certified appraisers. The two bodies become a main axis leading the appraisal market in the respects of numbers and works. KAB was originally established as a government-invested company in the form of a joint-stock corporation. Since the establishment, It has tried to expand its businesses to take-off for self-supporting development without aids of government. But, KAB is gradually losing its strong points as a public enterprise in the appraisal market because of recent government's deregulation policy. As for 27 private corporations, they have problems in themselves resulting from the personal combination structure that requires a unanimous consent to the decision making. They attend to business in the capacity of private person. 2.3 Scale of the Appraisal MarketThe scale of appraisal market tends to be enlarging every year. The total scale in 1998 exceeded more than 3 times as much as 290 billion won compared to 90 billion won in 1991. The growth of appraisal market by years

On the whole, the appraisal market is composed of the public and the private. Appraisals are carried out for the public enterprises including surveying the standard land price, the fluctuation rate of land price quarterly, and compensation for land expropriation etc. The private market falls under the appraisals for the request of financial institutions including the collateral & general transaction. Institutionally, the public sector is a pivot of appraisal industry in Korea. But, in the real market, the private sector is the central force of leading the market economy notwithstanding that we don't recognize. Comparing with the foreign countries, the ratio of public to private is to the contrary. Consequently, the Korea appraisal market has been developed by the public-initiated. As you see the above, the market share of the public appraisal occupies about 34% in amount 85.5 billion won such as notified land price survey, compensation, and national or public land in 1999. In a superficial view, the Korean appraisal market seems to be stable. It is true that the prospect of market is not so good. The hike in appraisal demand, in 1998, owed not to the increase of virtual demand but also to temporary rise of reappraisal demand caused by the currency crisis. The income from the public sector is expected to shrink because of the reduction of the public works. Therefore appraisers are asked to open up new market to surmount this hardship. 2.4 Public Notification of Land Price Policy in KoreaWith the enactment of Act, the land price has basically been valued on the basis of 'Standard Official Land Price' (the publicly government-announced price of the land (hereinafter 'standard land price') which is formally determined and recognized as a standard one by the government every year. The government commits certified appraisers to survey and evaluate the standard land prices. Basically, Land pieces which can serve as a standard for land prices of that area are chosen from among country wide land masses, and are called land samples (approximately 450,000 land pieces nation wide hereafter referred to as 'sample lands'). Each sample land should satisfy 4 criteria as a standard official land namely representation, moderation, stabilization, and certainty. It is the responsibility of the Minister of Construction and Transportation to survey such lands and notify the appropriate land price per unit area (won/?) on the first of January (it is, however, generally notified at the end of February). The Minister of Construction and Transportation asks more than two evaluation agents (appraisers) to survey and evaluate the sample lands. Evaluation agents choose the sample land and survey the characteristics of that land and its price level. These agents survey and propose an appropriate price for the sample land. Upon review of the opinions of the relevant city, district or county, the price is finalized. The land prices are notified in the official news letter once the prices are fixed upon review by "the Central Committee of Land Evaluation' over the evaluated prices. The standard official lands prices have wide application with appropriate. Whenever land is evaluated, the official price of sample lands should be applied (the article 9 of the Act). When calculating the price of a piece of land, for the purpose of administration, the standard land price should be applied (the article 10 of the Act).

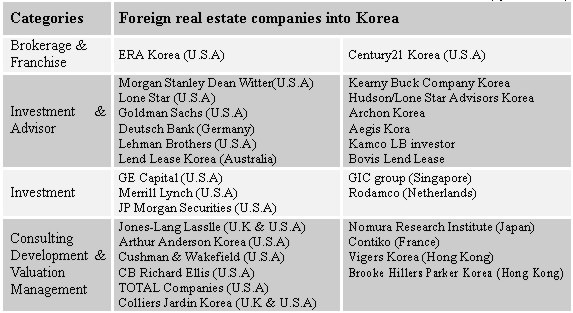

This policy successfully contributed to stabilize the land price for the administrative purpose. In the viewpoint of appraisal, it becomes the target of criticism for preventing from developing appraisal techniques. As for currency crisis, this stagnancy became one reason not to cope effectively with the change in market's circumstances. 3. THE ENVIRONMENTAL CHANGES OF APPRAISAL MARKET3.1 Foreigners Rushing to Korean Real Estate MarketWith opening real estate market to foreigners and currency crisis, the foreign real estate companies have made inroads into Korean real estate market and secure the strategic foothold. They have already gone into operation as multinational corporations having ample funds and the worldwide information network system. Armed with deep pockets, they are rushing to purchase local real properties put up for sale at cheap prices by businesses suffering a severe cash crunch. Their entry into Korea real estate market will be accelerated. What is serious, most of them are appraisal-based companies. In addition, It has become known that other foreign real estate companies have an intention of moving forward into Korean real estate market. These foreign companies are the global provider delivering comprehensive consulting, transaction, financial and investment management services. Besides, there is a sudden shift in the market changing from a seller's to a buyer's market. Strengthening the competitiveness of appraisal services against those of foreign companies, it is the key to satisfy the client's needs and meet what they want. The states of the advanced of foreign real estate

companies into Korea 3.2 Deregulation Policy of Real Estate & Appraisal MarketSince the currency crisis, regulations concerning real estate transactions are widely being relaxed and even completely abolished. The government intends to attract more foreign capital into the real estate market to fundamentally by opening the real estate market to foreign investors and abolishing regulations that discriminate against them. The virtual actions are taken for the purpose of boosting real estate market. As for appraisal market, deregulation measures such as the abolition of taking up two jobs, brokerage business and appraisal business, at the same time, the abolition of compulsory affiliation to Korean Association of Property Appraisers (KAPA), and permitting plural associations of appraisers. This chain of deregulation measures is intended to intensify self-regulating of appraisal bodies. In addition, the government relaxed restrictions on business that were classified by scales and increased the number of successful applicants for the purpose of activating market competitions. These steps were taken to go into business more easily inducing the principle of competition. Comparison of Measure to Boost the Real Estate

Market

3.3 Securitization of Real EstateWhen the crisis hit home, the land prices were sharply plunged, the financial institutions placed more weight on the intrinsic value of an asset than its nominal value. In addition, foreign investors utilize cash-flow income stream as a means of assessing real estate values. Traditionally in Korea, real estate prices have been determined based on the prices of neighboring estates and development cost. On the other hand, foreigners determine the price of real estate according to the present value of the future income stream it will generate. When 'Discounted Cash Flow' method is applied, the current prices of many estates are hardly justifiable. Recently, asset securitization began to see active use as a means to facilitate the selling off of banks' non-performing assets and to stimulate the restructuring of companies. Asset securitization converts various assets either tangible or intangible into cash flow through Asset-Backed Securities (ABS) issued based on those assets. With the introduction of ABS, companies and financial institutions are expected to accelerate restructuring, improve their capital structures. After all, since the IMF bailout, the Korean market is experiencing in its new concept of real estate. Breaking the traditional concept that real estate is something to hold on to, Koreans are beginning to think of it as something to use. Asset securitization will accelerate this change. When asset evaluation is applied to real estate, which is necessary to issue ABS, it causes real estate prices to form at a more reasonable level and bubbles in current prices are removed. Also the government plans to introduce real estate investment trusts (REITs) by the middle of 2001 in order to boost the sagging real estate market. Through REITs, many small investors will be able to indirectly invest in real estate, thereby expanding the huge potential demand for the real estate market. Foreign real estate companies that have already launched into the domestic market are also making haste with their own activities to enter the domestic REITs market. Foreign investment companies that have previously gained high profits through bad debt purchase in Korea are expected to raise the return of investment in REITs based on their advanced know-how, once REITs with high safety is introduced in the market. Having REITs be taken root in Korean real estate market without a hitch, it is necessary that the real estate value should be assessed on the basis of income it will generate. The income capitalization method will be the most likely acceptable method to estimate the values of properties. 4. THE SUGGESTIONS FOR DEVELOPMENTThe problems awaiting solutions are to hold a dominant position through developing the advanced appraisal method and to open up a new appraisal market. 4.1 The Network of Appraisal Information SystemThe 21st century is expected to be the age of digital economy based on developing the internet and information technology. We should establish the network of appraisal information system. For the first step, we should systematically collect and share appraisal precedents scattered all over appraisal market. The next, we should secure diverse and ample macro- and micro-economic market data relating to appraisal. However, with the absence of enforcement in current appraisal standard, there may be the discrepancies of opinions among appraisers. By building up the network, It will minimize the disagreement of them. Indeed, the more appraisal corporations access to the network, the more likely it is to become the de facto standard, spawning an add-on industry of its own. It is the network effect at work. The more appraisers, companies and web sites that are linked together, the greater the benefit to each of the participants. In addition, appraisers should need to become more international in focus. The globalization of real estate will require a greater consistency in appraisal report formats as well as professional standards and standards for Electronic Data Interface (EDI). There is a push for harmonization of professional standards and code of ethics. The reduction in trade borders results in international accreditation and a move towards truly international appraisal institutes. With the advances in accessing the network, the transformation of information is not difficult. It is encouraging appraisers to concentrate on the analysis and relatively of the information and its application to the assignment at hand. As a result, appraisers are expanding their business to include many other service sectors typically represented by other professionals containing appraisal and valuation services. Therefore Korean appraisal corporations ought to develop formal international networks to remain competitive against the gigantic accounting firms, particularly to retain their national and international clients. Actually, most appraisal companies run their web-sties with excellent contents and configurations. But each is not a network system but a mere method of publicity activities. As for Korea, the Korean Appraisal Board has established and started operating KREIC (Korea Real Estate Information Center) as from March 15, 1999, as one of the 100 agenda, under the supervision of the Ministry of Construction and Transportation. KREIC provides transparent and reliable real estate information of the international level through Internet as well as consultations to the foreign investors in more convenient and prompt fashion. But KREIC is now the level of information system. As you recognize, building up and driving network system is not so easy for the private corporations. Thus, it is desirable to be driven as a public enterprise under the supervision of the government. KREIC may be the alternate institute as an agency. To amplify the effectiveness, each web-site should be integrated and operated jointly. Appraisers can exchange their experience and expand their business scopes all over the world through KREIC. 4.2 Develop the Advanced Appraisal MethodKorean Appraisal market is not so small but its system is not enough to effectively cope with diverse needs of investors. We have to integrate the trifling small-scale appraisal corporations into several major companies to regain competitive power. The next, we should pile up the income/cost data of properties to draw yield rate of them. DCF is widely used for valuation estimate. DCF is a simple technique, yet as with the old computer acronym, 'GIGO' (garbage in garbage out)' the quality of the value number depends on the quality of the inputs. On the other hand, we try to search for measuring intellectual capital such as intangible assets. Present valuation techniques are not appropriate for valuing intellectual and intangible assets because their frameworks do not explicitly recognize potential value of intangible assets. The appraisal demands for them are likely to soaring up relating to recent M&A. The most important factor for appraisal becomes the productivity of properties they will generate. We should find out the best way to draw the productivity of properties from the market data. 4.3 Exploring the New GroundAs the economy has matured, there have been growing calls for more effective land use, and the trend toward the bifurcation of land prices as based on profitability and convenience has become apparent. Thanks to recent trends and new systems involving real estate, important new business opportunities have been created. The emphasis on effective use and income value, and the securitization of real estate will call into question the appraisal process and the reliability of the appraisal, as well as the appraisal result. This is the time for appraisers of ability and skill to demonstrate their worth. Promoting the disposal of non-performing loans and liquidation real estate is an urgent matter for the normalization of financing and the economic recovery of the nation. While making the most of "due diligence" for that purpose, it has become necessary to effectively use sites that is unused or under-utilized and diversify the financial of real estate that supports these measures, above all securitizing real estate. It is necessary to establish a financing framework to support the liquidation of real estate. Fortunately, the institutional framework and procedures for this are gradually taking shape. There is a so-called niche market of real estate that we are to preoccupy. 4.4 Follow Up the International StandardsIt needs to introduce the practical business guidance book such as USPAP (Uniform Standards for Professional Appraisal Practice) in U.S.A which includes "Code of Conduction" for appraisers to keep. Korea has only regulations generally defining the principles of appraisal by the construction & transportation ministry ordinance having no virtual effectiveness because there is little room to apply concretely. For the lack of concrete guidance book with compulsory ethics, they have always probabilities to happen discrepancies of results about the same subject chiefly relying on individual interpretation that may lead an error in judgment. It is needless to say that this may be the main cause deteriorating the credibility of the appraisal result. We should make guidance book standard to the exclusion of arbitrary decision. If the appraisers violate them, the guidance book should be raised to the status of "the Principle of Appraisal" to secure the power of execution. In the long term, they can be convertible to self-regulating. The contents will include detailed ethic codes, applications, essential requirements to report, and etc. It is very desirable that MOCT, KAB & KAPA has collaborated in revision of the current principle of appraisal to reflect the advanced standards such as International Valuation Standards (IVS) and International Accounting Standards (IAS). There is a sign of movement that appraisers voluntarily voiced up the necessity of "ethic codes" having a virtual effectiveness to improve the quality of appraisal results. It may cause clients including foreigner investors to have a confidence on the appraisal reports. 5. CONCLUSIONThe real estate appraisal system in Korea was started with the establishment of Korea Appraisal Board in 1969. In the 32 years since, appraisers have fulfilled important obligations related to appraisal in the national economy and the daily lives of individuals. These include public appraisals (the standard official land value, the fluctuation of land price surveys, tax appraisals, and appraisals of land purchased for public use), appraisals for court disputes including auctions, appraisals of corporate assets, reappraisal, appraisal for collateral, and appraisal for general transaction. In view of the large share of Korean assets accounted for by real estate, appraisers will continue to play an important role in the future. Nonetheless, the number of properties appraised in recent years has been declining. We do not know whether economic recovery will generate a recovery in our volume of work, or whether the volume of work is declining for structural reasons. Despite the ambiguous situation, we can not help trying to improve appraisal methods in the midst of on-going globalization. In view of the importance of appraisals for the public benefit, certificates of superior quality in terms of form and substance will be required. On the other hand, when the market value based valuation of real estate in line with International Accounting Standards is introduced, the form and content of appraisal certificates will be rigorously examined to determine whether they are in conformity with international valuation standards and whether they will withstand international scrutiny. Thus, we should acclimate ourselves to international environment introducing a competitive system to appraisal market. Considering our important role and the new business opportunities in a dynamic economic society, though current circumstances are difficult, we should say that the time has come for appraisers to be on the lookout for new opportunities and opportunities for development. REFERENCESChang Gu Yun, The development suggestions for Korean appraisal system, Korea-Japan society of the land law seminar, 1999. 10 Byeong Yun Jung, A study of the development direction of appraisal system, Korean Appraisal Review Vol. X. Feb. 2000 Il Soo Kim, The assignment of real estate securitization and value estimate, Real Estate Research, Vol.?. Mar. 1999 Won Min Lee, the development directions of appraisal industry in global era, Real Estate Research, Vol.?. Jun. 1999 Seong young Lee, The appraisal system & real estate market in Korea, Jun. 1998 Jong Nyun Kim, Introduction of ABS into the Korean financial market and its effects, samsung economic research institute, Feb. 1999 Kab Sung Kim, Trend and prospect of the Korean real estate market since the currency crisis, samsung economic research institute, Mar. 1999 Frank Spencer, The role of professional institute in relation to global communication and information access, Pan Pacific Congress, Apr. 2000 Takeshi Hiramine, The future business environment, Pan Pacific Congress, panel discussion, Apr. 2000 Willian B. Brueggeman / Jeffrey D. Fisher, Real Estate Finance and Investments, 10th edition CONTACTSangho Lee 30 April 2001 This page is maintained by the FIG Office. Last revised on 15-03-16. |